Navigating Turbulent Times Just over two months into President Trump’s second term, major policy...

From Tariffs to Turnaround: Markets Stage a Swift Recovery

In Like a Bear, Out Like a Bull

Tariff Turbulence and the Market Reversal

Markets entered April with extreme bearish sentiment after President Trump’s “Liberation Day” announcement of sweeping tariffs on both allies and adversaries. The combination of weak economic survey data and threats to oust Fed Chair Powell sent markets tumbling and recession odds soaring. A rare alignment of falling equities, bonds, and the dollar highlighted cracks in the perception of U.S. financial system stability and its traditional safe-haven status.

As volatility surged, the administration shifted course. Tariffs were rolled back to 10% across the board—with the notable exception of a massive 145% levy on Chinese imports—and rhetoric toward the Fed became more measured. Stocks rebounded sharply, including a one-day rally of nearly 10%. Under pressure from tech leaders and political allies, the White House carved out exemptions for many electronics, fueling a powerful rebound in mega-cap tech and broader equities. Stronger-than-expected corporate earnings and reassuring hard data helped restore investor confidence.

Corporate Earnings: Strong Results, Weak Visibility

Earnings season kicked off on a solid note. Q1 earnings are on track to rise 12.8% year-over-year. Meta posted robust advertising and AI revenue, while Microsoft reported 33% growth in Azure cloud services. Apple beat expectations, but Amazon's AWS revenue fell short. Both companies flagged heightened uncertainty, particularly around trade policy. A growing number of firms are declining to offer forward guidance, citing tariff risks—leaving analysts with fewer inputs to forecast future growth.

The April labor report told a different story. The unemployment rate held steady at 4.2%, and non-farm payrolls grew by 177,000—beating expectations of 130,000. Even net government jobs rose by 10,000. These strong labor figures diverge from weak PMI employment components, highlighting the disconnect between soft and hard data. April’s services PMI release is expected May 5.

Federal Reserve Outlook and Risks Ahead

Portfolio Positioning and Outlook

Against this backdrop, we continue to maintain a defensive posture in client portfolios. Our tactical allocation to European equities helped cushion the recent pullback, while our U.S. equity exposure ensured participation in the rebound. We remain vigilant and ready to make adjustments as the market environment evolves, with a continued focus on helping clients stay aligned with their long-term financial goals.

April was a rollercoaster month for the record books. President Trump’s escalation of a global tariff war and his threats against Federal Reserve independence triggered a surge in market volatility, ultimately forcing a partial retreat from Washington’s initial hardline stance. The backdrop of weak “soft” survey data contrasted sharply with resilient “hard” economic reports and stronger-than-expected Q1 corporate earnings—though more companies are withholding forward guidance—creating a uniquely complex market environment.

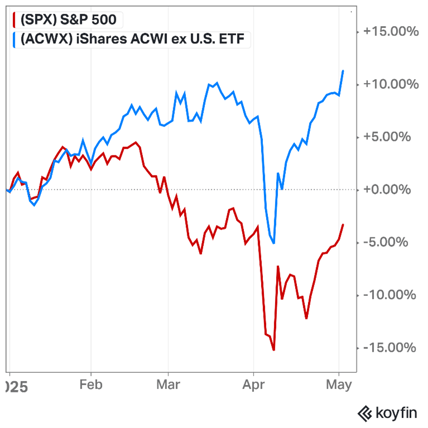

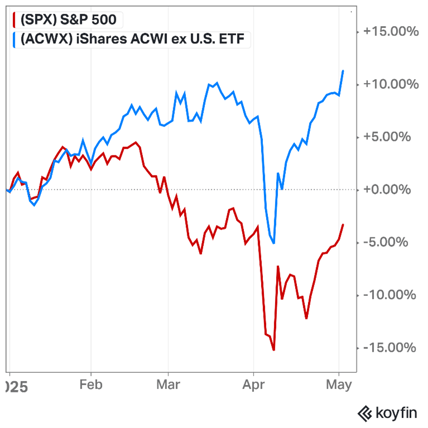

Despite the turmoil, the S&P 500 ended April down less than 1%, and 10-year Treasury yields were little changed. However, the U.S. Dollar dropped nearly 5% for the month and is now down over 8% year-to-date, reflecting investor rotation away from U.S. equities. The ACWI ex-U.S. index is up more than 11% YTD, compared to a 3% decline in U.S. stocks.

Tariff Turbulence and the Market Reversal

Markets entered April with extreme bearish sentiment after President Trump’s “Liberation Day” announcement of sweeping tariffs on both allies and adversaries. The combination of weak economic survey data and threats to oust Fed Chair Powell sent markets tumbling and recession odds soaring. A rare alignment of falling equities, bonds, and the dollar highlighted cracks in the perception of U.S. financial system stability and its traditional safe-haven status.

As volatility surged, the administration shifted course. Tariffs were rolled back to 10% across the board—with the notable exception of a massive 145% levy on Chinese imports—and rhetoric toward the Fed became more measured. Stocks rebounded sharply, including a one-day rally of nearly 10%. Under pressure from tech leaders and political allies, the White House carved out exemptions for many electronics, fueling a powerful rebound in mega-cap tech and broader equities. Stronger-than-expected corporate earnings and reassuring hard data helped restore investor confidence.

Corporate Earnings: Strong Results, Weak Visibility

Earnings season kicked off on a solid note. Q1 earnings are on track to rise 12.8% year-over-year. Meta posted robust advertising and AI revenue, while Microsoft reported 33% growth in Azure cloud services. Apple beat expectations, but Amazon's AWS revenue fell short. Both companies flagged heightened uncertainty, particularly around trade policy. A growing number of firms are declining to offer forward guidance, citing tariff risks—leaving analysts with fewer inputs to forecast future growth.

Mixed Economic Signals: Hard vs. Soft Data

Economic data remains mixed. Soft indicators point to growing pessimism: the manufacturing PMI slipped back into contraction, and the services PMI showed slowing expansion. Consumer sentiment is deteriorating, with inflation expectations rising and economic outlook readings near historic lows. Nonetheless, consumer spending remains positive, though cooling and may have been pulled forward in anticipation of tariffs. Businesses certainly did so, as a surge in imports dragged Q1 GDP down to -0.3%.

The April labor report told a different story. The unemployment rate held steady at 4.2%, and non-farm payrolls grew by 177,000—beating expectations of 130,000. Even net government jobs rose by 10,000. These strong labor figures diverge from weak PMI employment components, highlighting the disconnect between soft and hard data. April’s services PMI release is expected May 5.

Federal Reserve Outlook and Risks Ahead

The Fed remains on hold for now, leaning on hard data and waiting to see whether inflationary effects from new tariffs become entrenched. Although inflation is gradually easing toward the 2% target, policymakers are watching for signs of second-round effects. We expect current soft data to begin showing up in hard indicators by June or July. If the Fed delays rate cuts beyond that, it risks allowing economic momentum to deteriorate beyond easy repair.

Portfolio Positioning and Outlook

Against this backdrop, we continue to maintain a defensive posture in client portfolios. Our tactical allocation to European equities helped cushion the recent pullback, while our U.S. equity exposure ensured participation in the rebound. We remain vigilant and ready to make adjustments as the market environment evolves, with a continued focus on helping clients stay aligned with their long-term financial goals.